David and Rob touch on topics that almost every investor will deal with, such as: how to take on private money for the first time, creative ways to fund your rehab, tips for setting up a short-term rental, when to quit your job and pursue real estate full-time, and how to get rid of headache tenants.

David:

This is the Bigger Pockets podcast show 564.

Rob:

That’s what happened to me. I could not scale my Airbnb stuff, I couldn’t scale my YouTube platform. I couldn’t scale anything because I was working 40 hours a week. And so I had to make that decision, it’s time to quit because it’s actually holding me back. And the moment that I quit my full-time job, I was making $110,000 at this job. I significantly by many factors, increased my salary that same week. And it’s because I got 40 hours a week back to focus on everything that I was talking about.

David:

What’s going on, everyone? It is David Greene, your host of Bigger Pockets podcast, where it’s our mission to teach you how to become financially free through real estate. Now we believe that real estate investing is the best way for ordinary people to build wealth. And we prove it by bringing you stories of people who started out right where you are right now. Then we apply the simple but not easy framework. Look, real estate investing is definitely not rocket science, but that it doesn’t mean that it’s easy. It’s consistent steps in a positive direction that will get you big results over time. Here today is my amazing co-host Rob Abasolo. Rob, we tag team some live questions from listeners who throw stuff at us and we don’t know what’s coming.

Rob:

Oh yeah, man. No softballs today was all curve balls. But I think, really nice, man. I think it’s really interesting to kind of hear what other people are struggling with because we’ve all been there. I’ve been there, every single question that we had, I was like, “Oh, this is how I feel every day.” But when you get to examine problems from the outside and you kind of step outside of your personal situation, it kind of helps you really a problem much quicker than if you’re in it.

David:

I think that’s why it’s so valuable to listeners because we get on our own head and we see our own problems and we think whether this is the only part of real estate. Then you hear somebody else dealing with something who’s successful and you’re like, “Oh, I dealt with that long time ago.” And you realize I actually am making progress or I’m not the only one who’s going through that. So, today we answer questions regarding, should I start an LLC or should I do things in my own name? And how do I know which way to go? We had a guest who bought several properties at one time and is trying to figure out, “I have this much capital. How do I know which property to put it towards? And what order should I be moving in to get these things rehabbed and rented out?”

David:

We had a guest who stuck with tenants that aren’t paying their rent on time and they’re sort of held hostage because they couldn’t evict them during the moratorium, but now they’re able to, and they’re trying to figure out, “Well, should I keep the property or should I keep the tenants?” And they weren’t sure to do. Did you have any that stood out to you that you thought were particularly insightful?

Rob:

Yeah, definitely. Well, not necessarily insightful… More just like, “I feel you, man, I feel you.” We had one guest who called in and really trying to decide if… He’s making a very nice six figure salary and he’s like, “Should I quit this or not?” And as someone who’s been there myself, I really resonated with that because I just quit my full-time job back in April. So it really feels like, “He reminds… David, he reminds me of a younger me.”

David:

I knew that was coming. Yeah. And you gave some remarkably good advice on that. Everyone definitely makes sure that you listen all the way to that, because that’s probably other than, should I get an LLC or should I do it in my own name? The question at the front of everybody’s brain is, should I keep my job? Should I leave my job? Should I get a different job? When should I quit my job? Most people are here on Bigger Pockets because they want to have a life that is fueled by real estate, not by a W2 job and clocking into a cubicle. And so this type of stuff is very relevant. And I think we gave him a really good path to figure out at this point, you’re good to go. And that was a very talented person too. So, that’s nice to see how many of these people on Bigger Pockets are actually making progress.

David:

So we will get to the show very soon. But first today’s quick tip will be, go to biggerpockets.com/david and submit a question. We want more questions from people like you. We want to know what is on your brain. What do you wish that we talked about on the show? And we never actually get there? Well, this is probably the only podcast I’m aware of outside of maybe Dave Ramsey stuff, where you can show up and you can actually ask the questions that are on your mind and everybody gets to hear it. So please go there as well as biggerpodcasts.com/livequestions. And you could be notified when we’re going to be going live and show up and ask your question and get it answered. Anything you want to add before we get out of here? Get onto the show?

Rob:

Yeah. How do we get a back slash? I want a biggerpockets.com/rob. Can we get on that? Can we make that happen?

David:

Easy there.

Rob:

We just post a photo of my hair.

David:

Easy there grasshopper. All good things come to those who wait. Yeah. We were going to give me a back slash earlier, but we couldn’t figure out what to call it. So we finally got now.

Rob:

Well, hey, David was a little on the nose, but I like it.

David:

All right. Let’s get to the first guest. Maria Dennis, welcome to the Bigger Pockets podcast. You look so familiar.

Maria Dennis:

Yes, David. How are you? This is so exciting.

David:

I’m good. How are you doing today? Or should I say [foreign language 00:05:06]?

Maria Dennis:

I’m very good. Very pleased to be here. I’m so excited to ask the question. Kind of nervous to be honest with you.

David:

This is the second time you’ve asked me a question in the last week or so. I believe you’re in my mastermind and you asked a question there. Was it a week ago? Maybe two?

Maria Dennis:

It was a week ago, but it was a completely different question. I’m just waiting for your book to happen. So I can’t wait to read that.

David:

Awesome.

Maria Dennis:

I’m learning a lot of things from the mastermind by the way, just so you know. So…

David:

I’m very glad to hear that. Okay. What can we do for you today?

Maria Dennis:

So I wanted to ask you a question particularly about investing. And I think I told Eric about that. So basically, like I said, I did really well last year, thanks to your book, Sold, as an investor agent. And I’ve used that like a Bible just so you know. However, I’m in a position right now that I’ve worked with many investors. A lot of them are really trusting me now in this industry because I try to bring as much value as I can. And in my head, because I’m still an investor, I want to grow my portfolio. And I feel like most of these investors wanted to invest with me. So partnering up on real estate investing. But my fear is I’m still kind of new in a game, I’m afraid to take somebody else’s money and take that leap. So a little guidance is what I need to how do I do it? How do I start now that I know what the agent side works? But how do I do it legally that I’m benefiting and my clients are benefiting as well?

David:

Now, are we talking about a deal specifically with a client you’re representing them on, or just overall borrowing other people’s money?

Maria Dennis:

Basically borrowing other people’s money, maybe possible syndication or GP on something. Just something big, because I’m thinking this year I want to go big.

David:

So you’re looking for some kind of framework that you can operate out of to get started?

Maria Dennis:

Exactly.

David:

Rob, you want to take first crack at this one?

Rob:

Yeah. Yeah. Well, first of all, fundamentally, I think you got to think about what your mindset is around working with other people’s money and how you treat other people’s money. For me when I was getting started in this and I was working with different investors and everything like that, I really had this mindset where I treat an investor’s dollar like it’s four times more valuable than mine. So if I lose $100 for an investor, it feels like I lost $400 of I own money. That way I make every decision very critically and strategically and I don’t ever just like say, “Oh, it’s not my money.” It should pay you to lose money for other people. I really think that’s an important way to kind of level set when you’re starting to take on cash from a second standpoint of working with investors and everything like that.

Rob:

Especially from a mindset, a lot of people get very greedy and they’re like, “Oh yeah, I’m doing all the work. I want 50%.” And all this kind of stuff. I used to be very stubborn about that when I was working with investors, I was like, “I want 50% I’m doing all the work.” But what I quickly came to realize is that I am actually not the one that’s incurring any risk. So I would say, be very open minded with what kind of structures and partnerships and templates that you work through, don’t feel like you have to have 50%. If you have to start with an investor and you only get 25% or 20% or 15%, I think the experience that you’re going to get out of your first investor deal will be a lot more valuable than any type of equity split that you’re going to actually they have from that deal.

Maria Dennis:

That’s a great point. I think that’s what I did when I became an agent, I had that mindset of treating it as my own investing. And I think that’s how I became so successful that way. I never thought of it as a dollar, I thought of it more that will it work for my investor to make this work? So, thank you. I appreciate that.

David:

So when it comes to raising money, what I’m sensing is you don’t have enough direction yet on what you want to do with that money. And so if you have like, “Hey, I could do anything,” you’re going to do nothing. You’ve heard that phrase if you chase two rabbits, you’ll catch none. Well, this is like, if you try to chase 200 rabbits, that’s what we’re kind of at. So the first thing I think you need to do Maria, is figure out where you feel the most comfortable and the most competent investing yourself. You need to know the asset class, the types of deals, the area that you feel very good about and start with that. All of the what split do get? What do they get versus me like Rob said, that’s not as important, especially on the first couple deals. You knowing that you can go to someone and say, “Here is the plan,” is very important.

David:

What people that are in your position do that are new is they go to a person who’s very scared about investing money and maybe also scared about real estate, and they sort of say, “Well, what do you think we should do?” Which is the worst thing ever. I tell people it’s like your first day as a firefighter and they’re like, “All right, the building’s on fire.” And you’re looking around like, “Where’s the most experienced, strongest firefighter? I’m going to follow him.” And they go, “Oh, I don’t know what we should do. I’m after you.” Right? No one’s running into that building with that. So you want to sort of provide that clarity to the people that you’re investing with. The most practical advice I could give you, would be start with where you’re already helping clients. You know that market, you’ve helped them buy deals before. I can tell you’re confident investing there.

David:

So choose that market, get yourself pre-approved, figure out what your down payment’s going to be at the price point you want to be and you know that’s the amount of money you have to raise. It probably won’t be that big at least for the first one. So you could say, “Hey, I’m going to bring in 25%, you’re going to bring in 75%. I’m going to do this much work, you’re not going to have to do anything. And we’re going to split the profit 50/50.” That might be a nice place to start. And if they say, “Well, why do I have to give 75% if I’m only getting 50?” You could say, “Because I’m the one doing all the work and I have all the experience. If we switch roles and you do all the work, we’re going to lose our money for sure.”

David:

So, that’s probably where I would start with the deal. And then as you get comfortable in that market, you’ll start to get sort of the rhythm down of looking at property, what to look for, what mistakes were made. You’ll start to get more confident about moving forward, then you can start expanding into other markets or more expensive properties or some of these syndications.

Rob:

Yeah. I think I want to echo that just a little bit, just because for me I have found that when I’m working with investors, having a clear framework is pretty important. I have four or five or six tricks in my bag, if you will. And every single time I come to an investor and they’re like, “All right, I’ve got $500,000 what do you want to do with this?” Well, the moment I give them all six options. Like, “All right, so we can build a tree house, we can buy a house, we can rehab it, we can build a tree house in that house and then rehab the house.” The more options I give it, usually the investor starts getting a little bit nervous because they’re like, “Well, what is your thing?”

Rob:

So very much agree with David. That’s like, whatever your one thing is, even if you’re very good at multiple things, I would really try to be as laser focused as possible, because it’s going to be very easy for you to answer questions revolve around one strategy versus trying to answer questions around six different investment strategies and then now your investor’s a little scatterbrained because they have to think about, “Well, didn’t you say you do this with this strategy and this and this?” And there’s so much different explanation that comes along with your rationale for how you do things with every single type of investing model. So the more laser focused you can be, I think the more confidence you’re going to build in an investor.

Maria Dennis:

Perfect. Well, that’s great advice.

David:

Great point.

Maria Dennis:

Thank you so much.

David:

You know when you go to a wedding Maria, and they say, do you want the steak or the chicken?

Maria Dennis:

Yep.

David:

It’s a very easy decision. You just pick one right off the bat. You don’t want a menu that has 40 things on it that will then prompt them to ask you questions on all 40 things and say, “Well, now I need to go talk to someone else and see what they ordered. And I need to read the Yelp reviews.” You create way too much confusion and you’ll never go anywhere. Start with steak or chicken as you get that down, maybe there’s two kinds of chicken. You can sort of slowly expand, but that is way down in the future. The best thing you could do is to stay in your area of competency, what you know very well, the market that you know, and then you are an agent, so people are going to trust you because you’ve represented other people before and you’ll do great.

Maria Dennis:

So do you-

Rob:

I’m going to make that a sign, start with steak or chicken David Greene.

Maria Dennis:

So do you see it… Is it better for me to just focus on that one investor that would be bring value to me as well in order to bring that deal or multiple investors to a sense where I have more capital and then use that as a sense as I’m their main GP? So…

David:

If you have too much capital, but you’re not comfortable at where to deploy it, you’re going to feel pressured to buy properties that you don’t want. And that’s the worst thing ever. It’s going to be like all these people are pushing you from behind and you have to jump off a cliff, but you don’t know which direction you want to jump in, because you haven’t gone to the water below to see where it’s shallow, where it’s deep. That’s not a good situation to be in. You want to be able to take your time on the very first deal and know this is what I’m getting into, I know what I’m diving into, I know that I can make it. And then as you learn the areas that you’re diving into, you can slowly start to expand like what you’re saying.

Maria Dennis:

Perfect. Thank you. Thank you so much. This is awesome.

Rob:

Yes, I agree. [foreign language 00:14:26].

Jordan:

Hey, guys. Thanks for doing this and having me on. Big fans. So I appreciate the insight hear. But my question is if you guys have your properties listed in an LLC or under your personal name. I’m currently getting… I’m under contract for my first single family short-term rental deal. And I’m wondering whether I should keep it in my personal name or transfer the deed to my LLC. Because what I’m wanting to do is leverage the equity built in this first deal to purchase future properties. And I know I could do a HELOC if I kept it in my first name, but I don’t know if that’s an option under an LLC. So, I’m just curious your thoughts on how to leverage equity and how to best set up a business for success.

Rob:

Yeah, I’ve got some thoughts. Well, let me start with the caveat here. I’m not a lawyer, neither is David, and this is not legal advice. But in the past, anytime I’ve purchased short-term rentals… And honestly this changes from property to property, it really just honestly depends on how my attorney sort of instructs me on the state that I’m in. But a lot of the times what we’ve done is we will purchase a property and then we’ll do what’s called a quick claim deed into the LLC. Now, when you do that, it can trigger what’s called the due on sale clause, which basically means that the mortgage company, if they find out can call your mortgage due and you’d have to pay that back. So there are some caveats and some things you’d want to discuss with your attorney in doing that because that’s always going to be a risk with doing a quick claim deed, but there are really a few schools of thinking here.

Rob:

I’ve spoken to a lot of people that are seasoned hosts and I’ve even talked to attorneys about this. Most of the attorneys that I’ve spoken to typically want that LLC protection, but a lot of the really season hosts in the game will just have very good insurance. Very good renter’s insurance, very good short-term rental insurance that can cover you. And they may not necessarily have it under an LLC. So I can’t really to why one would do that or not, but it basically depends. Your mileage may vary and your attorney will probably instruct you a lot better than my nervous sweaty answer here because I don’t want to get sued. No, I’m just kidding. David, what do you think?

David:

That was a really good general overview of some things to be concerned about. Jordan, what are your specific concerns about your different options?

Jordan:

I mean, overall, the reason that I would want to use an LLC is just for protection, granted I don’t have a lot to protect right now because this is my first property. I have a residential home, my own home, but I want to scale this and make this a business and have multiple, multiple properties in the future. So, I kind of thought it was best to just set it up from the start and then that way I don’t have to worry about it down the road. So I guess that’s a reason why I would use an LLC.

David:

Okay. I think I see where we’re going. You’re seeing how this first step is a foundation and as you build this foundation up, if you get 17 stories high, you don’t want to have to go back and restart over. Is that kind of the fear?

Jordan:

Yeah.

David:

Well, here’s the good news. It doesn’t work that way. You can move them back and forth pretty frequently. Again, I’m not a lawyer, so don’t hear this and just say, “David told me I could do it.” There’s a way to go about it. Right? I have the strategy. I tell the people like my CPA or an attorney, “Here’s what I want to do.” They figure out how to do it. I can’t tell you how exactly to do it, but I will tell you that I move properties around all the time from one form of title to another. I would say one common misconception in my opinion is the belief that an LLC will protect you while having it in your name won’t. That comes from the understanding that if a property is held in a business, if you are sued, they can only take the assets that the business has. That’s where we say I’m protected. All right? That’s not always true.

David:

There’s many cases in court where a judge will look and say that LLC is managed by Jordan and is run by Jordan and is an extension of Jordan, and therefore they will do what’s called piercing the veil of the LLC, where they will say, if you’re guilty, right? You do something really… You leave a rabid dog in a house someone and gets bit, they can come after you personally, that LLC is not like this airtight I’m safe. So I would let go of that. It also creates a lot of complications with financing if you’re trying to get Fannie Mae, Freddie Mac products, which if you’re new in your career, that’s what you’re trying to do. So what I did and what I would say is a good option, is buy them in your name and get more homeowners’ insurance to cover you if you’re worried. So the policy will have protection against getting sued. And if that’s what you’re afraid of, jack that thing up as high as you are comfortably reasonable to handle, then you have to worry about the LLC.

David:

Now what happened in my career is I got to a certain point where I couldn’t get those kind of loans anymore, and I had to get commercial loans and the properties had to be in an LLC. So then I had to switch into them, but it wasn’t that big of a deal. I just transferred the title over there. And also when this happens, the due on sale clause, Rob talked about is a concern. It’s not at this stage in investing. It’s not a practical concern, but you could just refinance them. That’s what I did. Is I own them in my name, I refinanced him into an LLC, I got a better rate and the title was changed and I had no problem. So, I guess what I’m trying of highlight here is for everyone listening the whole, should I take it in my name or in the LLC is not hard set in cement and you can never change it. It’s probably the most over worried about question, I think in all of real estate.

David:

So I appreciate that you’re asking it, but you should just give yourself a sigh of relief because I don’t think it’s as serious as you think. The advice I do want to give is the ending is what will be affected by how you take title. So you want to ask your loan officer or the broker who’s doing your loan, can I get the loan if the title’s in this condition? Or what would have to change so that it does? And if you want to reach out to us, send me a message on Facebook Messenger or on Bigger Pockets, I’m happy to put you in touch with my team and they’ll get an idea of what you want to do and then they can say do it like this.

Jordan:

Awesome. Thanks, guys.

David:

Yeah. I also got to say the shaved head and light scratch thing you got going on. I really like it.

Rob:

You might be a little biased though. You might be a little biased.

Jordan:

Heck of a look you got going there, David.

David:

Thanks man.

Suzanne:

Hi, guys.

David:

Hey there, Suzanne.

Rob:

Hi, Suzanne.

Suzanne:

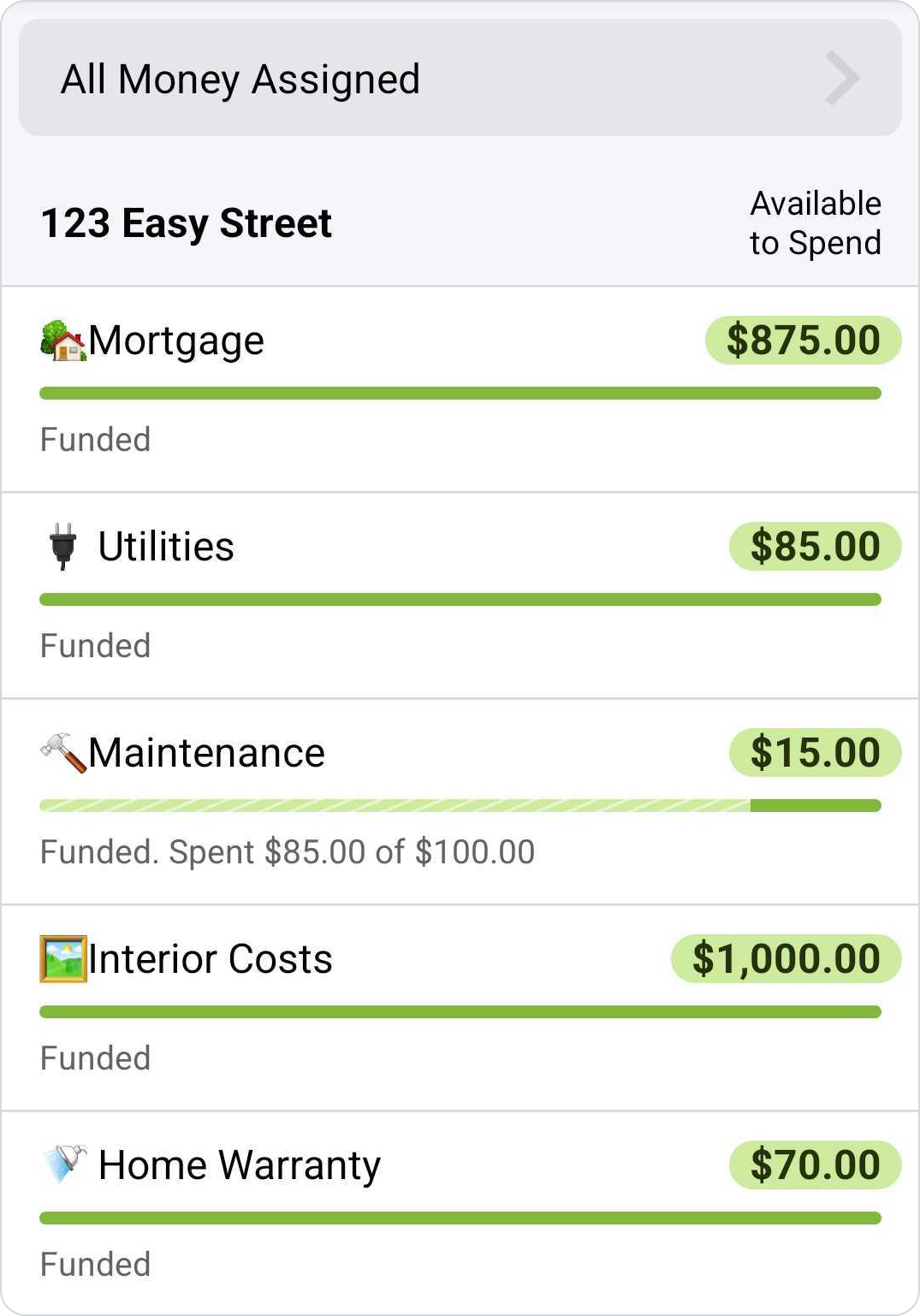

Hi. How are you guys? Thanks for taking my call. My husband and I bought four duplexes long-term, not long-term, long distance investing about a month ago and we moved our contractor to the area. So we have a great person to do the rehabs. I was wondering, is there any creative financing so that we can get that rehab done till we get to the BRRRR level? Because three of them are empty right now.

David:

Okay. So if I understand this correctly, you have a couple rental properties, several of them are vacant. They need rehabs, but you don’t have the funds to rehab them and they need to be rehabbed before you can refinance them.

Suzanne:

We have some funds, but I want to be able to not be stressed about the funding. We have 25% of the investment loan equity, and then we have probably 50 to 80,000 sitting around to get started on these rehabs.

David:

So did you-

Suzanne:

But I was wondering, is there a loan or is there besides a hard money loan, is there another way to fund rehabs or any creative investing ideas you have David?

David:

Yeah, I can start with this one. The easiest answer would be if you found private money from somebody else, I guess the first thing I’m hesitating with is if you have 50 to $80,000, how much do you need for the rehab of the first house?

Suzanne:

Our contractor said 40, but that’s not including appliances, cabinets, new hot water heaters, roofing, gas flow.

David:

So most of that money’s probably going to go to the first property. Right?

Suzanne:

Right.

David:

And then the other two are just going to be sitting vacant until you can do the work on those? So did you buy three houses at one time?

Suzanne:

Four duplexes and each duplex it’s empty, as in a different duplex. So it’s not like we can totally rehab one duplex and then BRRRR it out.

David:

You’d have to do both of them is what you’re saying? Right. So one thing I would consider would be do the bare minimum to get a tenant in there so you’re collecting rent on the ones you’re not rehabbing. And then the one you are rehabbing, you can put your funds towards that. So it would look like, get started on the first one, getting the first two units rehab so that you could refinance it and pull your money out. During that time, have tenants in the other ones if you can use them as short-term rentals or medium term rentals or whatever you have to do if it’s a long-term rental. So you have some income coming in and they’re not just dying. And then after you refinance the first one, you’ll have money that you could put towards the next one. And then that could be the money that you use. You don’t necessarily have to borrow it. So really all you have to do is solve the problem of how do you get the first one going? You have anything you want to weigh in there, Rob?

Suzanne:

Okay.

Rob:

Yeah. I was just going to ask, well, A, any amount of cashflow is going to be no amount of cashflow. And so I know it might seem like it’s putting you further from your goal of having it all done if you can only get one rocking and rolling, but it is a bit of a snowball effect. And regardless I think you’re going to get more value out of just getting one ready, rented, refinance that you can start it. You just may not… I think the big thing to understand here is you just may not get it all done at once. And that is going to have to be okay possibly. A lot of people get these projects and they want to be able to do everything and finish it and redo the paint and the appliances.

Rob:

But at the end of the day, there is no magical money printing machine, right? So we have to understand, “All right, we’re going to have to make sacrifices, maybe we can’t do the expensive wallpaper or the expensive laminate floors.” And you’ll just have to kind of be very budget friendly with how you approach renovating each specific one. But I did have a follow up question on this. Since you have four duplexes, now I’m kind of curious, do you have any other properties in your portfolio?

Suzanne:

I do. One’s in a retirement fund, one is I just refied it out and pulled some cash out to finish another property. And then I have a duplex that we have that’s completely renovated, but we’re using it as equity on a historic building that we’re going to renovate, which is great because it has great dollar for dollar tax credits once we get it approved through all the appropriate state and federal. So we’ll get a lot of tax benefits from refurbing that one. So it’s kind of anchoring that property down so we can get a million dollar line of credit to finish that one.

Rob:

Yeah. Okay. I’d have to dig into some of these details, but you may just have to focus on kind of which of those properties… Because it sounds like you have a lot going on. So, it sounds like you might have to focus on whichever properties are going to get you the biggest kind of return or cash out so that you can then funnel it into the next one. I know it’s not the sexiest answer, but sometimes it is the waiting game in real estate.

Suzanne:

Right. And these are going on simultaneously in two different states.

David:

Yeah. You sort of just took a really big bite and you’re like, “Man, how do I swallow this whole thing?” You had a lot of deals going on at one time. What stops you from taking a hard money loan to do the construction on the first one, rehabbing it, pulling out the money, putting that towards the next one, rehabbing it, pulling out the money, putting it towards the next one?

Suzanne:

Well, I actually have a hard money lender. I just hate to feel like I’m going further upside down or it’s a little hesitant because once you commit to paying something back or once you commit to, I’m only going to have it for this long, you’re kind of committed there. And I want to be a person of my word.

David:

So do you worry about not being able to pay back the hard money loan?

Suzanne:

Right. Getting it finished and we just bought these properties a month ago and the bank said it would take six months before you could pull out that BRRRR on what the increased equity would be. So having both sides done by then, and then being able to get the loan at that time with another major renovation going on on the historic property in another state, I’m just a little concerned about that.

David:

I think this concern’s not going to go away. This is just what happens when you buy this many properties at one time. And that’s not to put you down because I’m glad that you took action. But I would say you probably need to let lower your expectations of how quickly you’re going to get your money out of these, that you’re not going to hit it right on the six month mark. You’re going to have to take this big stake and cut it up into kind of like bite size pieces and you’re not going to be able to take the second bite until the first one’s done. I have to do this all the time. This is a big part of managing different businesses as I see all this opportunity come. And it becomes kind of complicated because you realize, well, we can’t do this one until this part gets done. But this is being held back by this thing. And this problem’s stopping all three of those from working.

David:

So it becomes a complicated endeavor to try to keep all these moving pieces going. And it sort of feels like a Rubik’s cube. You got to get all of them lined up just right. I want to sort of encourage you that this does not mean you did something bad or wrong or you’re a bad investor. You just bought a lot of properties at one time and you don’t have enough resources to add to all of them. So what Rob and I are really talking about, is how do we stop the bleeding? How do we get some tenants in the ones that you can’t fix to buy you some time, focus your resources on one, maybe two if you possibly could, but probably one. Get it stabilized and move on to the next one and give yourself grace that it’s not all going to happen perfectly.

David:

Here’s what will likely happen. Okay? You’re starting off at ground zero and you’re looking at how I can build my equity and my passive income. You’re probably going to dip down from ground zero before you go back up. And you have to be okay. This happens to me all-

Suzanne:

It’s hard to do.

David:

… the time. It’s very hard, but it’s an emotional problem. It’s not an actual logistical one. You have funds, you have money, you have access to loans, you can do this. You have to release in your heart this idea that it shouldn’t go bad. This happens to me. I just bought a 1.8 million place and the tenant was supposed to… I bought it from the owner and he decided not to leave. And that was costing me 10 grand a month for this mortgage. And I can’t even start construction. And then not only would the owner not leave, but we couldn’t send anyone to the house to get measurements, to submit to the city for permits. So we fell behind on that too. And then finally he gets out of there and now my contractor had taken another job. Okay?

David:

Every one of these delays is $10,000 a month that just keeps adding. And I’m looking at like, my goodness, every month I’m losing money. And if that’s all I see, I’ll never invest. But when I look back at this five years later, I’ll say, “Yeah, it just took me six more months or nine more months before I hit the profit I was expecting.” And over a 30 year period of time, who cares? And so when we only look at right now that you feel like crap, you’re probably not sleeping that well, it’s on your mind all the time you feel like you screwed up. You’re like, “Why am I even doing this?” A lot of people would have those emotions. It’s okay to let something get worse before it gets better. And here’s the bright side. Most likely you probably got house is at a good price.

David:

So you probably had some built in equity when you walked into it. Okay? During this period of rehabs to you is going to feel unreasonably long and like you’re losing money because you suck. You’re actually going to be making money as they’re appreciating in value. Okay? There’s always something that balances it out and you’re like, “Oh, that actually worked out great.” Our rains just harbor in on that one mistake and we miss the several things working in your favor.

Suzanne:

Right. Thank you so much.

Rob:

Yeah. And I also want to bring up that it’s not like a loss, it’s not like a bad thing if you have to sell something. I like to hold, obviously I’m sure David likes to hold too. But if you have to sell one of these duplexes to get your 25% back, that’s fine. I would rather you feel very comfortable and safe with 25% down to finish three of your duplexes, than you hold onto them and bleed out from the funds. Right? So I might consider that like. It might be a breakeven, you might lose a little bit, I’m not a hundred percent sure on that, but that’s always an option. And that’s not a loss. That’s actually very smart and strategic in a situation where you’re not sure how you’re going to pay for any of these rehabs.

Suzanne:

That’s an idea I hadn’t thought of. Or maybe get the first one done and sell it.

David:

Yes. There you go. And then that could fund the rest of them. All right. I had a comment or I was going to ask you a couple questions. Did you have questions you wanted to get answered before we wrap that up?

Suzanne:

No, that kind of answered my questions. A little nervous about taking the hard money loan, because I’ve done that before and it took a little longer to pay back than I had originally planned, but that all worked out. I’d be interested to hear what you have to say or your advice David.

David:

Do I have your permission to go a little deep here?

Suzanne:

Yes, absolutely.

David:

I think this will help a lot of listeners. All right? So what you just said right now, absolutely supports what I was going to ask where you said, “I was nervous to take out a hard money loan because I’ve done it before and it went longer than expected.” And I’ve noticed that theme has come up with almost every question you have, is there’s an expectation of how it should work. And if it doesn’t go according to that plan, you get very nervous and anxious and it’s almost like there’s emotional pain that’s associated with I messed up. I didn’t do it right. And I wanted to ask you, did you have an experience when you were younger with a parent person who is important to you that was a perfectionist and it was not unfamiliar for you to be reminded that you were not up to par and you made mistakes and you needed to be better?

Suzanne:

I would say not parent wise, but I’ve been really tough on myself of meeting my own expectations. And I’m probably my hardest critic on meeting goals, meeting deadlines, meeting financing, that sort of thing. But not parent wise.

David:

So, that usually comes from some form of relationship. Could be someone you dated, could be someone you… A sibling. Who knows where it comes from. But there’s usually a feeling that I’m not enough, I don’t measure up. And in order to get rid of that, we start telling ourselves, you need to be better, you need to do more. And here’s why I’m bringing this up right now. It’s affecting your ability as a real estate investor. Because these things that you’re talking about, nobody would be expected to hit all of these timelines perfectly. Real estate just doesn’t work that way. And as you’re thinking, I got to get both of these birds done exactly at the six month thing, that perfectionism is starting to cause emotional pain, which stops you from taking action and keeps you spending energy that could be used to solve problems. And instead you’re just feeling bad about yourself and you’re using that energy to try to protect yourself from bad feelings.

David:

So, as crazy as this might sound, because it’s not practical advice. If you could identify where that started, what relationship it came from or where you picked up this habit. I don’t know. Maybe let’s say I got cut from a sports team and I felt horrible and I had to watch all my friends playing basketball and I didn’t get to play anymore and I made that agreement with myself that I will never again let myself if not be the best or not be good. I don’t want to feel this anymore. And that perfectionism takes root and then I carry it around my whole life. Well, it stops me from ever playing another sport because I’m afraid what if I find out I’m not good enough? That’s an example from my life. I don’t know yours. But if you can identify where that’s coming from and forgive that person or forgive yourself or just say, “Hey, no one ever said I have to be perfect. There is no perfect.”

David:

Outside of Rob’s hair right now, perfection does not exist. All right? And I really think that if you can release whatever that is, a lot of these questions that you’re asking us here, the solutions will hit you. It’s like they’re probably right there in front of you, Suzanne. There’s a source of money or there’s a solution to this deal, or there’s a way that you can figure out this problem very easily and you just can’t see it because you’re putting all this energy into feeling bad about yourself because you’re not being perfect. And I just want to, if no one else tells you, I want to tell you this is normal. They never go perfect. We have another caller on this show and we talk about how he’s terrified of, “What if I miss something?” You’re going to miss something. There’s no way you’re not going to miss something. Everybody misses something all the time. That shouldn’t stop you from wanting to move forward. You shouldn’t be feeling fear and pain and anxiety over that.

David:

And I can see that that’s a great thing. It’s probably one of the best parts of you as a person is you don’t let people down, you probably always show up for them. But if you’re holding yourself to that same standard of you can’t let yourself down and doing anything less than perfection is letting somebody down, you got to adjust that standard. It’s stopping you been able to hit your potential when it comes to investing. If you’re buying this many properties at one time, you’re a person meant for greatness. You’re going to go do great things. So, change your definition of greatness from perfect to really good.

Suzanne:

Okay. Sounds great.

David:

Thank you Suzanne.

Suzanne:

Thanks so much.

Scott:

Hey, thank you guys so much for taking me on as a guest. Big fan of both your content. So, it’s a great experience for me. So, I just recently got my first short-term rental under contract in Blue Ridge, Georgia. I’m not taking the advice of staying in my backyard, which I know Rob would be shaking his head at, but it’s just the market I really liked and wanted to jump into.

David:

Well, first off, Scott, Rob says to stay in your own backyard because he’s got 17 backyards. He moves all over the place all the time. So, that’s not-

Rob:

Fair, fair point.

Scott:

Yeah. That’s true. That’s a good point. He is all over the country. So I guess that’s easy for him to say, right? But-

Rob:

You never know where you’ll find me.

Scott:

But anyway, the plan for me would be to essentially pack up my car, I want to get down there to see the property in-person and then putting together my shopping list for Amazon, Costco, and then the plan is essentially to just start purchasing things, work remotely there for a couple weeks, get my cleaner and my photographer in. And then once I go live, just make my drive home. I’ve done all the research, watched all the videos, but I still just have this big pit in my stomach that I’m going to get down there and realize I forgot something or that I’m just going to slip in my preparation somewhere, end up being there way longer than I thought. So just like hearing my initial plan was wondering if you two had any kind of things like keep in mind type things or just any kind of guidance or advice if any part of my plan strikes you as a bad idea. I know you both have short-term rentals. Rob, I know it’s your specialty.

Scott:

So just looking for a little validation/any kind of guidance because I’ve done all the preparation I can, but I still just can’t shake this pit in my stomach that I’m going to be halfway down there and be like, “What am I doing? I made a mistake.” So, just anything you guys have to say.

David:

I’ll say two things. The first is that’s normal what you’re feeling. It doesn’t mean you did anything wrong. Everybody feels that. The second thing I’ll say is, I don’t think there’s a better person I could possibly advise you to talk to than Rob. So, I’m going to let him jump in and tell you everything that he’s thinking because he’s probably the best person I know at this type of a question.

Rob:

All right. Let’s dive in. Okay. So, here’s the good news, bad news. Good news is… Or bad news, let’s start with the bad news. You are going to forget something. You’re going to forget a lot of things. That’s the bad news. The good news is it’s okay. You know why? Because you can buy anything anywhere. And honestly Blue Ridge is a really great market, did you buy your place fully furnished by any chance or was it a empty house?

Scott:

Yeah, it’s pretty much fully furnished. The main things are taken care of, but I know there’s still stuff I’m going to want to add. So I’m still putting together my shopping list. So it won’t be huge assembly full furnishing, but I still plan to spend at least a few thousand, just to make it as perfect as I can and just make sure I’m not cutting corners up front, trying to like cheap out. I want to make sure I am really going all in to make this a great stay.

Rob:

Awesome, man. Well, biggest mistake I see hosts make is they don’t splurge, especially in these situations. They’re like, “Oh it’s Blue Ridge or the Smokey Mountains, it’s already fully furnished. There’s nothing to worry about here. I’ll just kind of come and change a thing here.” And they kind of cheap out. And that’s what really ends up biting you in the butt. So I’ll say this. Your short-term rental is really not going to be ready for the first three months of hosting. And that’s just the truth. Even with me, I’ve got like a bunch of resources that I put out there. It sounds like you probably have my shopping list, if you don’t, I have a shopping that’s out there. Great.

Scott:

I got it.

Rob:

And you’re going to buy all those things and you’re going to think you’re ready to go, it’s going to be fully furnished, you’re going to be like, “Ah, I did it.” And then one month in, you’re going to have a guess that’s like, “Hey, the Roku’s not working.” And then you’re going to think, “Oh my goodness, I didn’t set that up how did no one ever flag this beforehand?” So the good news is that when it’s a brand new listing and people understand that, they’re typically pretty flexible. You might have to refund people 50 to a 100 bucks here and there because the Roku remote didn’t have batteries and that was one thing you forgot, but that’s fine. Use your first set of guests as an opportunity to optimize your listing. Anytime a guest checks in, “Hey, how’s everything? This is a brand new listing by the way. So if you have any feedback, please let me know. I want to make this a five star experience.”

Rob:

And rather than just fixing that or addressing that feedback after they’ve checked out, try to fix it right then and there. Anytime a guest brings anything up to me, I will usually Amazon Prime something to them, I’ll overnight it if I can, or I’ll just pay the extra shipping to have it there. And I’m able to solve problems very, very quickly. So don’t feel like it has to be perfect, just so long as there’s a couch, there’s a bed, there’s a TV and a toilet, that’s all people really care about. Right? So you can optimize as you go. Obviously you want it to be as ready to go before you go live. But it is just not how short-term rentals work. And that’s going to be the big nuance between a long-term rental where you don’t have to furnish at all and a short-term rental where you have to buy 2000 things.

Rob:

So you’re correct in feeling this pit in your stomach, because that’s how it always feels when we get started. But it is the way it goes. Even me having done this, I’ve set up 25, 30 Airbnbs at this point. I forget stuff all the time. And it’s always like a little thorn in my side, but that is just… It’s part of the process. And really the only way that you can get better at becoming an Airbnb host, or really just being the best Airbnb host out there, an expert, is you kind of have to forget things and you have to learn things the hard way. So as much as I want you to have a very seamless and perfect experience, I kind of want you to fall down every so often, have some bumps and bruises, because that’s what makes us a better host. So, conceptually your plan here does work. If you’re going to move out there for a couple weeks, great. I’ve set up all my Airbnbs in a weekend.

Rob:

So, already you’re steps ahead of me. If you’re staying there for three weeks. Awesome. One big warning I’m going to give you is that 99% of the work that you’re going to be doing is on the final three days. I just know that. So, try to really space it out as much as you can, but anytime I have two or three weeks that I’m going to set up an Airbnb, it all happens down to the wire when I’m leaving. So as long as you kind of know that going in, maybe it’ll help you kind of hustle throughout the whole time. But yeah, there’s no downtime, man. So, it’s like very stressful in the moment, but it’s a very big laughing experience after the fact. And it’s a very happy thing once you actually have those professional photos in hand and you smile and you’re like, man, I made this. So with that, thank you for coming to my Ted Talk. Sorry. Do you have any follow up questions on anything I said?

Scott:

Yeah. First of all, thank you for the guidance. It makes me feel a little better and yeah, I was going to just use my phone to take the photos of the listing. That’s cool with you? Right?

Rob:

I know you’re messing with me. I know you’re messing with me. No. To get it up and running it’s fine. I do say that, but yeah. Pay that 300 bucks to the professional photographer, you’ll make that back in the first week.

Scott:

Yeah. Absolutely. I got some reserves set aside, so I want to make sure that I’m not choosing to cut corners on the little things, go with the furniture that’s durable, get the pictures I really like, just try to make it so I can charge it a reasonable amount and cover my expenses by a bit. And yeah, hopefully this my first of many, but yeah, huge fan of all the content you guys put out. I’ve binge watched everything you’ve put out, Rob, David reread your books a million times. So, I just want to thank you guys both. And don’t be surprised if you see me continuing to pester you on Instagram because I tend to do that to both of you here and there. So, really appreciate it guys.

Rob:

We encourage it, man. Yeah, you’re going to crush it dude.

David:

Right on, Scott.

Scott:

Thanks guys.

David:

Tyler, come in live from the 1920s. It looks like you’re in black and white there.

Tyler:

Is it? Yeah. Unfinished basement office. That’s what it is. So-

David:

Right on.

Tyler:

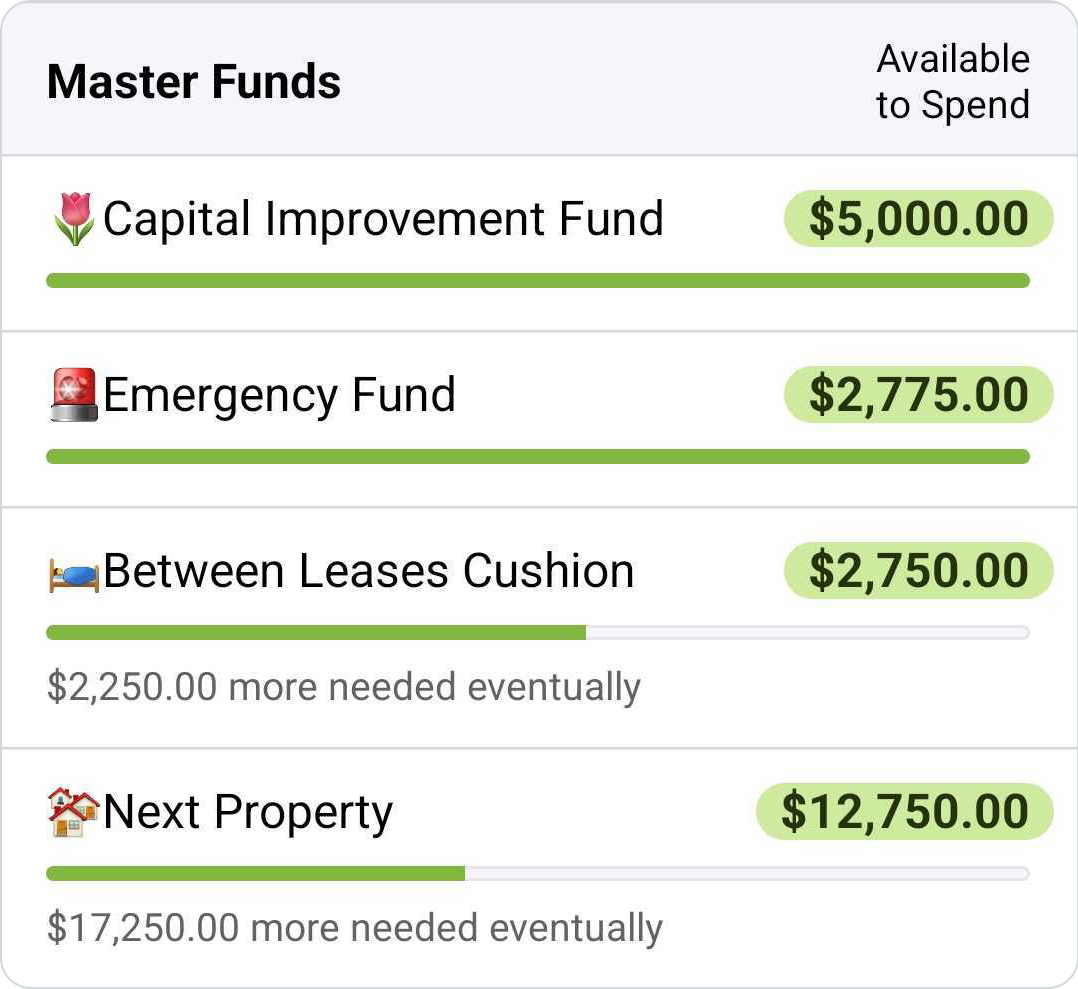

And it plays a part into this story, I guess. So, just looking for a little bit of guidance or thoughts from you guys. Big fan of yours too, but quit my job back in 2018 to pursue real estate as a realtor, which did pretty good. My first few years here and wasn’t looking for employment, we bought our first property and now we have two more that we bought. And then we have about eight more units that we’re negotiating on. But taking this job about seven months ago, which is a… I mean it was a pretty big opportunity averaging about on track to make 160K a year doing it. But it’s been affecting my mental health essentially, family. I mean, it’s been tough. And then the hours have been really tough in the sense of we have seven doors right now, two of them are occupied.

Tyler:

We have two remodels going on right now. One that’s getting wrapped up, two that are down to the studs right now. And then a single family house that’s on the back burner. It was a cheaper cash purchase. So not a big deal, but we’re seeing it affect our scalability or our growth and our real estate side. My wife and I have kind of already talked about it. We’re kind of to the point where, “Hey, we need to look at why did we quit our jobs in 2018 to begin with?” So we didn’t really seek out employment opportunity, but just kind of wanted to get you guys’ thoughts and see what you guys’ thoughts on that were.

Rob:

So are you questioning if it’s worth keeping the job because it’s affecting your mental health and-

Tyler:

Yeah. No, I don’t think it’s worth keeping the job just because it’s affecting my real estate business too, and we want that to grow. That’s why 90% of people that are on the podcast or that are in real estate, do it for family usually or whatever it is. Everyone around us kind of thinks… Most of the people around us in real estate and investing in it, they think it’s crazy to leave a job that’s paying six figures and wife stays home and we’ve got a pretty comfortable life doing it, but we were comfortable before. So it’s like, is that extra income worth it?

Rob:

Let me ask you this. Are you a salaried employee, hourly employee, how does that work for your job?

Tyler:

Straight commission. Straight commission.

Rob:

Oh, okay. Cool, cool. And what is the line of work?

Tyler:

Work as territory manager for an HVC distributor essentially. So, dealing with dealers and selling HVC, which is I was in the trades, I was on the dealer side of it before. That’s when I left because that was labor intensive as well.

Rob:

Sure.

Tyler:

But we’re just seeing it affect… I mean, the biggest thing is, it’s affecting our rental portfolio.

Rob:

Okay. Well I guess there are a couple things here. It sounds like if you’re on commission for the most part and you’re making $160,000, it sounds like you’re very good at your job. And it also sounds like you’re giving all of your mental health to your job and you’re just absolutely crushing it. I would say that it sounds likely that someone else’s 100% effort is pretty close to your 20, 30 or 40%. So, typically when I find people in this scenario, it’s they’re working too hard and they don’t have to. They all want to be a good employee and they all want to serve their company. And I get that. But at the end of the day, I would very much… I don’t know. This is kind of unconventional advice. So, David feel free to-

Tyler:

I’m going to say, I [crosstalk 00:47:31] see my wealth grow than the company I work for. You know what I mean?

Rob:

Yeah. And at the end of the day, I’m always like, you don’t have to come guns blazing into work with just the greatest performance all the time. I think it’s okay sometimes to not give everything you have to a job so that you can give that leftover energy side hustle. And so I would say… Look, I’m not really going to sit here and tell you to quit $160,000 job, especially if that pays the bills and it’s covering all your debt service. But I am going to say maybe don’t work so hard on it. Try to perform, if you’re on commission, maybe take on less leads or less leads generation and cut back on your time and hours in that job, so that you can at least not dislike the real estate side of your job, because at the end of the day it sounds to me like you want to do real estate, but what I don’t want is for you to not have the cash to fuel that. And it’s not fun. It’s not fun to work a job that you don’t want to.

Rob:

I did it for a long time. I was in advertising for 10 years. I had a great team and great company behind me, but towards the end of it, I was like, “I am not going to let this company be my identity.” And I kind of meld it in a little bit, but in doing that, I was absolutely crushing it on the real estate side of things to the point where I overcompensated. And when I quit, I was making a lot more money on the real estate of things and I was at my company. So I don’t know, if that’s an option to just maybe cut back on hours or the leads that you’re taking on, I might try to transition slowly versus just like cold Turkey quitting. My personal advice. But David, what do you think?

David:

Let me ask you. With your portfolio, what do you have going on there that you don’t have enough time to get to?

Tyler:

Well, so contractors are an issue with everybody, but yeah. So having the vacancies is obvious an issue. We’re not upside down on them, we have enough cashflow coming in to cover even the vacancies we do have, but we just want to see it scale faster and we kind of feel like if I left… Like I said, I didn’t pursue this job they came to me and offered me the position and I was like… I told them no at first, and probably should have stuck with that answer to begin with because I don’t need the job, but we kind of thought, “Oh, having that job is going to maybe make us be able to scale real estate, but actually we’ve seen it be more of a hindrance, even though that the money’s there, the time to put into the real estate is no. Working 12, 13 hours a day in this job, make it… When you convert the hourly rate, I might as well be working 100% on my real estate portfolio at that point.

Tyler:

You know what I’m saying? And I guess I don’t really know what I’m looking for as far as… We kind of know where we want to be with things. Last year we took an RV trip for a month and a half. Can’t do that now. So we want that time freedom back. But at the same time, we want to continue to scale, which we’ve got good relationships with lenders and everybody that we can still buy properties. We’ve got plenty of capital to back it as well. Plus we’ve got liquid cash, plus we’ve got 250K in line of credit that we can purchase property with.

David:

Here’s how I would simplify this. In order to build a real estate portfolio, you need capital or money, time, and then opportunity. Or maybe you can make skill. You have to know what you’re doing. So assuming you have skill, then you have to have opportunity. So, deals. Okay? The job is offering you money, but it’s taking away the energy. It doesn’t sound like… When I say taking away… Taking away your time, that’s a better way.

Tyler:

Right.

David:

It doesn’t sound like opportunity is a problem for you. And if you’re telling me that the only value that the job is offering is money, but you already have money, then it’s a stumbling block. It’s getting in your way of your goal. Right? What Rob was saying earlier was under the assumption that maybe you need this money. We kind of assume that’s why you have the job. Because why else would you be doing it? Right?

Tyler:

Right.

David:

So here’s what is most likely going on with you? And I have to deal with this all the time in my own life. And so that’s why I recognize it. You’re getting something out of that job of knowing you’re good at it. They wanted you, you told them no, they kept coming. You know you’re skilled, you know you’re good at sales. It feels really good every time you hit that number or you see your name at the top of a list. And what you’re actually doing is you’re trading your time for that. You’re telling yourself it’s for the money, but it’s not because you have access to lines of credit and money in other areas. So that will sort of make this a much more easy decision for you to make if you recognize that the real reason I’m working there is the recognition I’m getting or the feeling of significance because they need me. I don’t know. You can figure that part out talking to your friends about it.

David:

But if you don’t need the money, you don’t need the job. So all we have to be figuring out now is how do you decide if you want to cut back your hours like Rob said, or if you want to leave the job completely and maybe you leave that door open. Right? Maybe you go scale your portfolio and then you… I mean, honestly gets a point of buying rental properties like I did where that actually stopped being fun. I don’t want another single family house. I can’t do this anymore. And I wanted to go take another job and do another thing. So be aware of that as well. But this habit of understanding, is this helping me with my goal that we’re walking through right now, will serve you no matter what stage of your career you’re in.

Rob:

Yeah. I do have a POV now that I have a little bit more context, what I have always told people, because this was very true for me. And of course your mileage may vary. But I say with the whole job thing that a lot of people that want to get into real estate and they say, “Okay, I want to quit my job.” And I’m like, “Okay, well first, you have to work that job to get to the point where you are making the maximum amount of money doing that and working your W2 or your full-time job.” And so, when I start thinking about when I should quit my job or when that actually becomes a real opportunity, is the moment that you can no longer scale. You can physically… You can literally not scale until you quit your job.

Rob:

And it kind of sounds like that’s where you’re at. So, that’s what happened to me. I could not scale my Airbnb stuff, I couldn’t scale my YouTube platform. I couldn’t scale anything because I was working 40 hours a week. And so I had to make that decision, it’s time to quit because it’s actually holding me back. And the moment that I quit my full-time job, I was making $110,000 at this job. I significantly by many factors increased my salary that same week. And it’s because I got 40 hours a week back to focus on everything that I was talking about. So it sounds like you need your time back to me.

Tyler:

Yeah. Yeah I think that… Yeah. I think that gives a little more comfort to it too because we do have… Right now we have two, four units that are pretty much going to be under contract and then another 25 unit storage facility too that we’re working on. But we’ve got the deal flow, we know how to find deal. Before I even quit my job, I got my four year education on Bigger Pockets just working in my work truck every day and putting the podcast on. So got the knowledge and we’ve got the capital built up. We flipped houses all through, well, both my wife and I were working, but once we had kids, it was like, “Hey, we got to do something where we’re trading.” I think we were just on a podcast recently we’re trading five days a week just to get two and it’s hindering our real estate too.

David:

Do you want me to give you some encouragement that will make this easier for you?

Tyler:

Yeah, let’s hear it, David.

David:

We’re in a highly inflationary environment. And what that means is that money itself becomes less valuable and assets become more valuable. So you’re actually putting the majority of your effort into the thing that’s giving you less of a return, saving up all that money is great, but it’s not worth as much as you think. Right?

Tyler:

Yeah.

David:

That $160,000 a year next year might be worth 115,000, next year might be worth 95,000. It’s really bad. And the properties that you could have been buying, they’re going to go up exponentially. So this is actually something that is happening in my own life where I’m recognizing inflation is just getting so bad that I need to put less time towards making money and more time towards getting more assets under contract because that’s the smarter wealth building move.

Tyler:

I like it. It’s great.

David:

All right, Tyler. Thanks, man. This was really good. Appreciate you.

Tyler:

Thanks, dude.

Rob:

Yeah. Appreciate it. Hey, good luck, dude. I think you’re close of being where you need to be my friend.

Tyler:

Yeah. I think we’re on the right track. So, appreciate it.

David:

What you got for us, Rachel.

Rachel:

So calling in to get your advice on a property that I purchased last year. It’s a fiveplex that sits on a bit of extra land where potentially we could build more nuts, but I’m having some difficulty with the property. I knew we were going to have some issues going into it, the property wasn’t in the best condition. And I knew in that state, the tenants that kind of came along with the property may have some issues as far as paying their rent, et cetera. So since then we have continued to experience delinquencies and we just can’t seem to get the property performing. So, I’m wondering at what point should I consider other options such as selling?

David:

Well, let me ask a couple clarifying questions here. When you say you can’t get it performing if we’re just being straightforward and honest, what’s stopping it from performing?

Rachel:

Getting tenants on track with their rent payments.

David:

Okay. And I’m going to take you down a line of questions here that I’m going to let Rob jump in. But if we’re digging into why we’re having a problem getting tenants on track with their rent payments, why do you think that is?

Rachel:

So, one issue is that the tenants have been their long-term and I didn’t have the opportunity to screen them. And I should have mentioned at the beginning that this purchase was somewhat of a rush. I had a 1031 exchange and some proceeds from it that I had to put into another deal.

David:

Totally. Yep. And I’ll just… Let me jump in for everyone listening to this. It still often makes sense to buy a deal with problems like this if it’s a 1031. This is one of the reasons that people overpay for property when we’re like, “I’d never buy that. That’s only a 4% return. They’re paying too much.” No, not if they’re saving $300,000 in taxes, they’re not paying too much. So different people are in different situations. I’ll also say in my experience, landlords don’t sell their property when they have good tenants. So almost every time that you’re buying a property that has tenants in it, you’re buying a problem or the landlord wouldn’t be selling it. So, okay, go ahead and jump in where you basically inherited these bad tenants. Do you feel that if you could get them out that your tenant base would be solid and it would be easy to find good tenants?

Rachel:

I believe so, because that would give me the opportunity to, if everyone were out at the same time to go in, we have it a little bit and then put potential tenants through a proper screening process.

David:

But are the people that live there likely to be the kind of tenants you want to manage?

Rachel:

Are we talking about the current tenants or future tenants?

David:

No, the ones you’d replace them with.

Rachel:

Yes.

David:

The people that live in that [crosstalk 00:58:34] area I should say. Is this like an oil field where you’re going to have a bunch of crazy people getting in fights and your tenant. Right? Is it like a rough and tumble area or is it pretty solid?

Rachel:

No, I wouldn’t say that. It’s actually a university town. So I see there’s potential there.

David:

Okay. That’s what I was worried about. I was afraid that you just ended up with a property in a stinker location and there wasn’t going to be much you could do to improve the experience. But if it’s just that you inherited some problem child’s, I would say you should start down the path of if they don’t pay their rent, just going down the eviction road. Possibly once you get them motivated enough, they realize they’re going to be evicted it’s going to ruin their credit. You could look into cash for keys. I would say at this point when you already have these bad habits in place to try to change their mind is just not going to happen. They are used to having the landlord before you that let them get away with this type of behavior, now you asking for rent on time in their head, they resent that. They think you’re being a jerk and you’re being a tyrant. Right?

David:

And you’re looking at it like, “I’m letting you guys off the hook every single month you should be so grateful,” but they’re not. The only way you reach that expectations in this is a clean break. So, I would have a property manager and I would tell them, I need to get the tenants out when they miss a rent payment, when they violate the lease, what options do I have for just saying we are not going to continue your lease? And if you don’t have enough funds to float it during that time, maybe you just systematically do this one by one.

Rachel:

Right? Now that makes sense. And I do have a property management company in place. We just haven’t really made a lot of progress, I think because of where the property is located and the moratoriums that were in place and just the local laws. It’s more difficult to get tenants out.

Rob:

Yeah. I think… I’m not super experienced on the long-term side of things, but with the long-term tenants that I have had, unfortunately I think David’s right here, which is like once they have a track record of paying late, there really is no way to reverse that. So you may have to… I probably wouldn’t go all at once because there might be not a statement, but if you evict one person over this, then maybe the other people in the property will start to shape up a little bit. But it does sound like you need a clean break on this. I was just kind of curious… I mean, I would never really say sell it or anything like that, if you can fix the problem, which I think you can, but I’m kind of curious, do you have equity in this property that you could roll into a new property and kind of help you get to… A property that can maybe help compensate for this one at the same time?

Rachel:

Right. At this point, probably not because I bought it midyear 2020, and based on the condition of the property not being able to really go in and make repairs, I don’t think I’m going to see of upside right now.

David:

What about a refi? Could you do a cash out refi, put that money towards another property that makes money while this one’s struggling?

Rachel:

I could. I haven’t actually looked into that yet, because the purchase was so recent, but I can definitely ask my lender.

David:

That’s what I would recommend. When people come to us with these problems, that’s one way that we would look at it. And I believe you’d have to have them double check it, check with your CPA, but you could probably pull the money out that you put in on the 1031 exchange on the refi without any kind of a tax penalty.

Rachel:

Okay. That’s a good point to look into actually. So you would just hang on and kind of try to turn the property around and clear the way-

David:

There’s always so many nuances when… Because this is kind of my job as people come to me with a property that they own and I give them advice on what we could do with that. Should we keep it? Should we sell it? There’s a few things I look at. One is this comparison of return on equity versus return on investment. So, all of us know about ROI. If I put this much money in the property, this is the return that I will get. But you also have to look at the equity in the property and say, what return am I getting on the equity? So a lot of the properties that I first bought at my ROI when I bought it was maybe 12%. And with rent increases, it’s at 65, 75% and I look like I’m crushing it.

David:

Like, “Oh, I have 75% ROI.” But then I look at the equity that’s in the property and I’m getting a 2% return on that money. It’s terrible. Right? So, the next question would become, I need to take the equity out of that property that’s not working hard for me and put it somewhere else. So there’s two ways to do that. A refinance or selling. If it’s an area that I like that I believe will continue to appreciate where I’m going to get good tenants, I just want to own there. I look at the refi option first. If it’s an area that I don’t like, or it’s a property I don’t like, it just has a floor plan that is going to work, it’s on a super busy street that I’m always going to have a hard time getting tenants or something. Then I look at the sell option. So it’s not a hard and fast rule, it’s not a computer code that you can just say if this, then that, but that’s generally the path that I start looking at for clients.

David:

And what you’re saying is it sounds like this is a good area, it’s a good property. It just has… The tenants are the problem. Right? So you don’t have to throw the baby out with the bath water, so to speak. You just have to either tell your property manager very firmly. I want the tenants out if they don’t pay on time, can you do that? And if they aren’t helping you, just find another property manager and interview them and say, I need to get these tenants out so I can get people in that pay on time and we can all make money. If I hire you. Can you do that?

Rachel:

Yep. Now that makes total sense.

David:

Any last words, Rob?

Rob:

No, I really like this strategy. That’s kind of what I was getting here. If you can use this to get into another property that can help sort of carry the slack, it’s very rare that in five, 10, 15, 20, 30 years, this property’s not going to be… It will always appreciate to the point where you’re very happy that you held onto it. So I think whatever you can do to sort of fix the problem, or at least get you to the point where you’re not draining money every single month, if that means that you replace the tenants or you get another property that just kind of carries a slack here for the next few years, I would probably go that route before just kind of getting rid of the property or anything like that.

David:

All right. Well, reach out if either of us can help anymore. And thank you for being on the podcast.

Rachel:

Thanks a lot. Have a good one.

Rob:

Bye, Rachel.

David:

And that was our show. That was a great time. We got some challenging questions thrown at us, but I think that we helped some people. What do you think, Rob?

Rob:

We did, man. I was sweating there. We got a couple legal questions and I just-

David:

Love those.

Rob:

Because you didn’t sense my uneasiness, I do want to say we are not attorneys or legal professionals. So make sure to consult an attorney for anything that has to do with legal.

David:

Absolutely. But everything else, we want you to bring that to us. So go to biggerpockets.com/david, biggerpockets.com/livequestions. Submit your question. We want to hear from you. Also, if you’re not already doing so, please subscribe to the Bigger Pockets YouTube channel, where you can share your likes, dislikes, questions, concerns, all of it in the comments. We all read those, especially the nice things that people say about me and you too, Rob. I’m sure that we’re probably going to get some dragon balls references pretty soon here. And let us what you’re thinking because we watch that and we want to hear from you. All right. If you would like to follow me, I am DavidGreee24 on all social media. Rob, what are you?

Rob:

Hey, were there 23 other David Greenes before you on social media?

David:

It’s so funny that you say that. One person asked me if it was a Kobe thing, right? Because I have that killer attitude. No, I wish it was something cool like that. It was literally my basketball number in high school. And when I first made social media, there was another David Greene and I’m very impatient. So I just was like, how do I get this done as fast as I can, having no idea that anyone would ever actually be following me at some point in life. And so now I am locked in with DavidGreene24. Brandon hates it by the way. He constantly tells me I need to change it to, the underscore real David Greene or something like that. But-

Rob:

I think you should change it to the realest David Greene.

David:

The realest?

Rob:

Yeah.

David:

That’s not bad. Well, we want to hear from you. What do you guys think by social media should be? Great point there, Rob.

Rob:

So, to answer question, sorry. I always derail you on these. You can find me on YouTube obviously, smash that subscribe and the like button, leave me a comment @Robuilt, on Instagram I’m Robuilt and on TikTok someone beat me to the punch unfortunately. So you can find me at Robuilto because I had to add an O to it. So, Robuilto.

David:

That’s funny. I’m sure it was a coincidence that another person picked Robuilt on TikTok before you got there.

Rob:

No, man. You know what? Someone reached out to me the other day and they’re like, “Hey, do you want to buy Robuilt.com for $24,000?” And I was like, “You’re the guy on TikTok?”

David:

Yeah.

Rob:

And so, Robuilto it is. I had to settle for the .co.

David:

All right, well thank you very much for your effort today, Rob. It well appreciated and well received. This is David Greene for Rob, Robuilto Abasolo. Signing off.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!