This year, no one could predict what would lie ahead for the housing market during the novel Coronavirus pandemic that spread across the globe like wildfire. For many, Canadians lost their jobs and were trying to live off government-assisted programs while trying to juggle their bills, but for others, they were presented with a great opportunity to dip their toes in the real estate market for the first time or upgrade to a house outside of the expensive city due to being able to work from home. Interest rates have also continued to stay at a historic-low in order to help stabilize the Canadian economy while COVID-19 rages on.

But while some buyers were able to get into a home, many others were left losing bidding wars and give up on their dream home. Some even had to sell their homes in order to stay afloat. So, the question remains: is it a good time to buy a house in Canada? What real estate trends are emerging and why should you take advantage of them?

We’ll break down everything you should know.

Are millennials the reason for the booming real estate market activity?

Last year, it was predicted that millennials would become the main reason for homes flying off the market before the COVID-19 pandemic urged people to stay at home and only go out when necessary to essential stores. In fact, millennial home ownership rates in Canada were higher than in other countries according to a report by RBC. As of March 2019, 40 per cent of homes in Canada were owned by buyers 35 years of age or younger whereas, in the United States, that percentage sat at 34.5. The cities with the youngest homeowners in Canada were Calgary, Toronto and Vancouver, even despite the high home prices. But did this trend continue into 2020 despite the global pandemic?

Well, maybe not. Scotiabank’s survey suggested that 38 per cent of Canadians believed that now is as good of a time as any to buy a new home, but only 18 per cent of Canadians between the ages of 18 and 34 agreed that the pandemic accelerated their plans to delve into the home ownership journey. This left one-third of those surveyed waiting for prices to drop before buying a home.

How has the Coronavirus affected the housing market in Canada?

Despite the novel Coronavirus putting everything on hold, there were still real estate records being broken in cities all across the country, particularly in the Greater Toronto Area, Greater Vancouver, and Montreal to name a few. As mentioned above, while many feared losing their jobs and steady income to support their family and keep their houses running, many others found the global pandemic a great opportunity to buy their first home or upgrade to homes located outside of the city they no longer needed to travel to for work because of the lower home prices, affordable mortgage rates, and being able to get much more for their money.

Here are some impressive records that were recorded this year due to the Coronavirus that threw us all for an unexpected loop.

Montreal

Many Montrealers are saying goodbye to city living and buying homes in cottage country. In both July and August of this year, Montreal saw a surge in home sales and broke records for two months in a row in a seller’s market. This means there has been way more demand for homes than what is even on the market. In a report from the Quebec Professional Association of Real Estate Brokers (QPAREB), residential sales increased by 39 per cent in August compared to the same time last year with a total of 4,878 sales (with single-family homes taking the lead with 2,601 sales). This was the highest number recorded in August in the last 20 years. Single-family home prices also increased by 24 per cent (with a median price of $427,500), but what was surprising was seeing $1 million-dollar homes on the market double compared to August 2019.

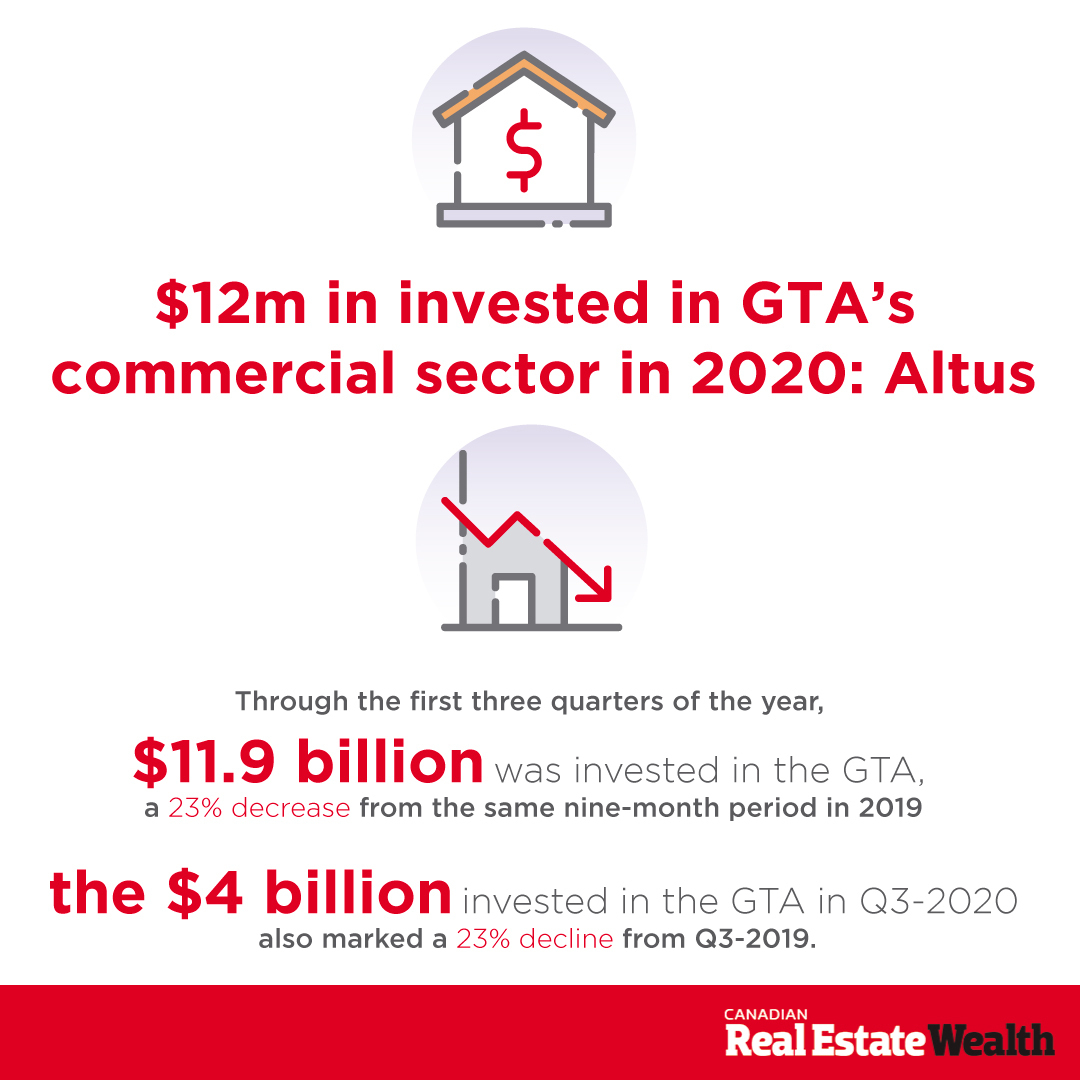

Greater Toronto Area (GTA)

The housing market in Toronto has reached new heights too after the global pandemic took its toll on office workers and real estate investors. As stated in a November report by the Toronto Regional Real Estate Board (TRREB), home sales in the GTA were up more than they ever have been for four consecutive months. In October alone, TRREB members reported 10,563 home sales compared to 8,445 in October 2019. The average price for all types of homes combined reached $968,318, an increase of 13.7 per cent from the same time last year. The demand for single-family housing in the GTA has drastically increased, so bidding wars are being taken to a whole new level. Supply is low and first-time buyers are getting outbid.

The condo market in Toronto has seen records being broken too. As the Toronto residential housing market has been doing really well, condos haven’t necessarily seen the same light, particularly in the downtown core. Sellers are even seeing their condo listings sit for months compared to just a few days this time last year. The reason? The demand for renting has drastically gone down because students haven’t physically been returning to school, immigration has come to a halt, and travel is a no-go for those offering an Airbnb. In fact, condo sales saw a year-over-year decrease of 8.5 per cent.

Greater Vancouver

The Real Estate Board of Greater Vancouver (REBGV) reported that in September of this year, 3,643 residential homes sold compared to 2,333 in September 2019. The benchmark price for all properties is currently $1,045,100; a six per cent increase since October 2019. In Fraser Valley, sales were the second-highest they’ve been in July for 10 years with an increase of 25.5 per cent despite the single-family home and townhome supply being low.

But the condo market?

Well, unlike the GTA, the Greater Vancouver area saw a 36.9 per cent increase in condo sales this year in September. Prices have remained high year-over-year because of the demand for buying condos in the busy, downtown hubs. The current median price of a condo in Vancouver is $683,500. However, those who own investment properties in Greater Vancouver have definitely noticed a drop in rent prices due to the lack of students, immigrants, and tenants losing their jobs or being laid off. In fact, in August, rent had dropped by 9.4 per cent compared to August 2019, according to Rentals.ca.

Top six things you should know before buying a house in these record-breaking housing market times

This may seem obvious, but buying a home is one of the biggest purchases you’ll ever make in your life. It may also be one of the most stressful times of your life, especially if you’re a first-time buyer and new to the world of real estate. But that shouldn’t scare you away. Buying a home is exciting, exhilarating, and something to be incredibly proud of. That being said, there are still some things you should make yourself aware of before buying.

1. Mortgage rates are at an all-time low

The main factor driving Canadians to accelerate their plans to buy a house? The historic-low interest rates.

Obviously, 2020 has been an uncertain time for all of us and the unemployment rates have drastically increased. In order to stimulate the economy and make it easy for people to borrow money, low-interest rates became the new normal and they may continue to stay this low for the next three years according to the Bank of Canada. There are a few reasons why people want to take advantage of this:

- This could mean substantial savings for monthly mortgage payments

- Those refinancing their mortgage will notice a huge difference

- May be easier for people to recover their debts

- Buyers can make larger purchases

- Banks are able to lend to even more borrowers

However, if you have a fixed-rate mortgage, you won’t be affected by the rate change. With an adjustable-rate mortgage, your interest rate and mortgage payments can change.

2. You need to become familiar with local real estate trends

If you’re interested in buying a house or an investment property, your best bet is getting familiar with local housing trends and, of course, relying on professional help from a real estate agent who knows the market better than anyone. Not only can they tell you what you’ll expect to pay in certain neighbourhoods, but they can keep you up to date on all information and facts you need to know so you’re as comfortable as possible with your purchase with it be for personal use or investment purposes. If you’re looking for an investment property, it’s also a good idea to rely on a real estate agent who knows what the rental market is like in the area, what you can expect to charge for rent, and what type of renters you should attract. Becoming familiar with the local housing market will also help you set your expectations seeing as bidding wars are becoming quite the fuss. Which brings us to our next point.

3. Prepare for a bidding war (even if it doesn’t end up happening)

Bidding wars and getting worse for buyers amid the global pandemic, leaving buyers feeling devastated they didn’t land their dream home. Why is this becoming such a popular (and hated) trend? Because of the inventory problem. There are more buyers looking for homes than there actually are on the market, leaving buyers’ agents having to pull every trick they know from their hats.

Bidding wars can be frustrating for everyone involved. Ultimately, when it comes to winning a bidding war, knowing how much you can actually afford to spend is crucial because you may need to increase your original offer. You may also want to consider having fewer conditions on your offer to stand out from the others.

4. Ensure that your income is steady before rushing into the housing market

As mentioned above, many Canadians across the country have lost their jobs due to COVID-19, or they’ve had to endure a pay-cut. If you’re someone who has been handed down this financial burden, it may not be the best time for you to buy a home for personal or investment purposes. Plus, when you apply for a mortgage loan, banks will favour those who can prove they have a steady source of income so they can make their monthly mortgage payments on time. You’ll also need funds for a down payment and closing costs, otherwise, if you need to borrow a down payment on top of a mortgage, it will need to come from a different lender than that of your mortgage loan in Canada.

5. Shop around for the right mortgage for you

Shopping around for a mortgage online is more easily accessible than ever before since pretty much everything is moving to the digital world due to the Coronavirus affecting in-person transactions. But finding the right mortgage for your specific needs can be tough to do on your own which is why many buyers lean on a mortgage broker for help. A mortgage broker’s role is a bit different than your agents. Rather than connecting you with the right house, a mortgage broker connects you with the right mortgage term and lender. They’re not just connected to one lender, but various lenders who offer different rates that are better suited for you.

6. Determine if your goals are short-term or long-term

There are many good reasons why people want to get into the real estate market, but when to actually buy a house depending on your goals can vary. So, what are your real estate goals? Do you want to buy your dream home for your family? Do you want to buy a house for investment purposes?

Signs it may be a good time to buy a house for short-term investment purposes to maximize revenue can be:

- You’re financially stable/comfortable enough to put a down payment on a second home (plus you have a good credit score)

- You’re able to access a good interest rate and mortgage rate

- If you don’t have enough for a down payment upfront, you have enough equity to tap into in your first home

- You’ve done your research to determine when it’s a buyer’s market or a seller’s market – a buyer’s market will mean that there are more properties for sale than there are buyers’ interested, so bidding wars may not be as common, but lower prices will!

- The investment property you’re interested in is in prime rental spots for positive cashflow

Signs it may be a good time to buy a home for long-term living purposes may be:

- You have enough saved for a down payment and closing costs

- You were able to sell your current home

- Your credit score is good

- The interest rates are low

- You’re ready to commit for the long-run and are financially stable to do so

- The housing market is in good condition and your home will actually appreciate

- Again, you’ve done your research – the neighborhood is what you’re looking for, the price is right, and the housing market is stable

So … is it a good time for you to buy a house?

Well, ultimately, it depends on a few factors. Whether you’re a first-time buyer, downsizing, or an experienced real estate investor, some of the most important things you will want to consider are:

- The current interest rates being offered by various lenders

- What your mortgage rate will be

- Where you’re looking to buy

- The current home prices (and if you are in good financial standing with your bank)

- The current state of the housing market

- If it’s a buyer or seller’s market

Because of the Coronavirus, many sellers have been nervous to sell, but even while the pandemic has put everything on hold, it seems like many people have been eager to get into the market. This has made some Canadian cities see record-breaking sales, particularly from July to October 2020. Some cities haven’t seen such high sales in years, but even more impressive has been the interest rate prices which have actually hit historic lows.

So, if you are financially set and ready to move into your new dream home or look for your first home, now may be the right time, but just remember that you may come across bidding wars due to the demand for homes being greater than what is actually available.

Are you looking to invest in property? If you like, we can get one of our mortgage experts to tell you exactly how much you can afford to borrow, which is the best mortgage for you or how much they could save you right now if you have an existing mortgage. Click here to get help choosing the best mortgage rate